End-of-year update

By Jarrod Fowler, MHA

FMA Director of Health Care Policy and Innovation

This has been a big year for healthcare in Congress. After a government shutdown occurred over the still-unresolved issue of whether to extend the enhanced ACA premium tax credits that were temporarily enacted following COVID, the Centers for Medicare & Medicaid Services (CMS) released a new physician fee schedule rule that will affect Medicare reimbursement. Here in Florida, new data about the state’s physician workforce was released in November. If you missed previous articles about these issues, get up to date by reading the following end-of-year overview.

Enhanced premium tax credits

Under the original text of the Affordable Care Act, millions of individuals and families earning between 100% and 400% of the federal poverty level (up to around $129,000 for a family of four) were eligible to receive an advance premium tax credit (i.e., a subsidy) to help them afford private health insurance on the exchange — presupposing that they met certain criteria, such as not otherwise having access to qualifying coverage.

During the COVID era, the income limit attached to the advance premium tax credits was temporarily eliminated, and the subsidies were made significantly more generous, slashing premiums. However, these enhancements are set to expire under current law at the end of 2025. In part because of the significant cost, it is unclear whether they will be extended, modified, or allowed to sunset.

The issue remains contentious and is still under debate in Congress at the time of writing.

2026 Medicare physician fee schedule final rule

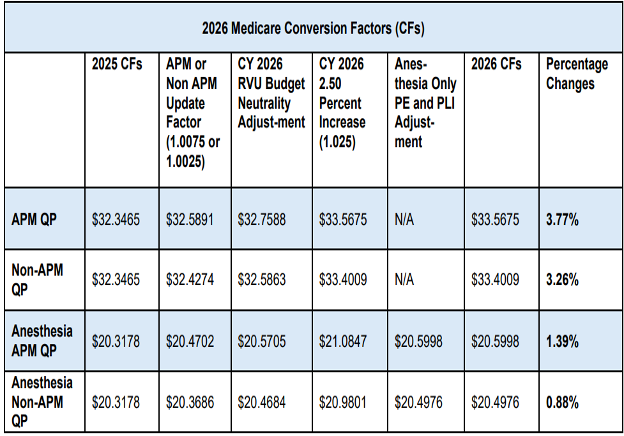

The fee schedule conversion factor is affected by several elements, including budget neutrality adjustments largely tied to a problematic “efficiency adjustment,” and a one-year 2.5% pay update that Congress passed to account for inflationary pressures. Overall, for physicians who don’t participate in an advanced alternative payment model (A-APM), the conversion factor will rise from $32.34 to $33.40 (a 3.26% increase). For those who do participate in an A-APM, the conversion factor will increase to $33.56 (a 3.77% increase).

A complete overview of the fee schedule is

available here.

Fee schedule sustainability

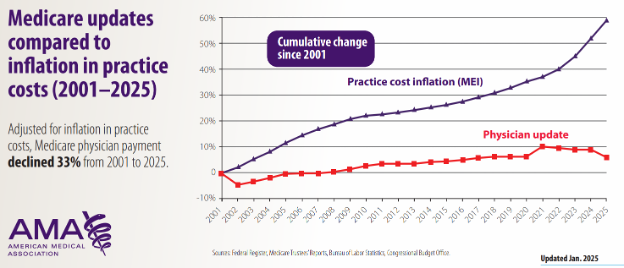

Policy organizations increasingly agree that the conversion factor needs more significant and sustained updates to ensure a healthy Medicare program. As the AMA recently stated in comments to Congress, “In their June 2025 Report to Congress, the Medicare Payment Advisory Commission (MedPAC) expressed concerns about the growing gap between physicians’ input costs and Medicare payment, warning: “[t]his larger gap could create incentives for clinicians to reduce the number of Medicare beneficiaries they treat, stop participating in Medicare entirely, or vertically consolidate with hospitals, which could increase spending for beneficiaries and the Medicare program.”

MedPAC therefore recommended that Congress repeal current law updates and replace them with annual updates tied to MEI for all future years. The 2025 Medicare Trustees Report reiterated similar concerns about patient access to care, stating that under current law, “the Trustees expect access to Medicare-participating physicians to become a significant issue in the long term.”

At every available opportunity, the FMA will continue advocating for our long-standing goal of increasing Medicare payments for physicians.

Source:

2025 Medicare updates compared to inflation chart | AMA

MIPS

The FMA has policies calling for the payment penalties associated with MIPS to be repealed, as these penalties have not been shown to assist physicians with providing patient care. Fortunately, CMS did not raise the performance threshold needed to avoid a MIPS penalty in PY 2026. This likely means that fewer physicians will be penalized in PY 2028.

Florida’s evolving physician workforce

The Florida Department of Health released the

2025 Physician Workforce Annual Report last month. Among the highlights:

Supply and demographics

•

In Florida, 62,209 physicians provide direct patient care. Nationally, this number is around one million.

•

Physicians 40-49 years old make up the largest age group, but 35% of Florida’s practicing physicians are 60 and above.

•

Women represent 33% of the state’s physician workforce. Nationally, 37.6% of physicians are women.

Geographic distribution

- Florida is home to 25 physicians per 10,000 residents. AAMC data shows this as being roughly in line with the national average. However, Florida has a substantial shortage of physicians across several specialties, which would require an additional 3,835 physicians to address. The state also has a rapidly aging population that, in some cases, has higher-than-average healthcare needs.

- Alachua County has the highest ratio of physicians to residents (60 per 10,000).

- Many rural counties have fewer than 10 physicians per 10,000 residents.

Specialties and primary care

- Internal medicine physicians (28%) and family medicine physicians (15%) represent the largest groups by specialty.

- While 1,461 OB/GYNs in Florida deliver babies, 550 (37.6%) reported that they plan to discontinue obstetric care within the next two years.

- All but one of Florida's 67 counties have at least partial primary care shortages.

Medicare acceptance

Just over 95% of physicians say they accept new patients with Medicare, but more than 2,045 physicians across the state do not.