How will the congressional reconciliation plan affect Medicare payments?

By Jarrod Fowler, MHA, FMA Director of Health Care Policy and Innovation

Congress is currently debating a bill that would update, renew, and overhaul many provisions of the tax code while also making changes to other federal programs, including Medicaid, Medicare, and SNAP. Understandably, a great deal of attention has been focused on the Medicaid funding cuts in the pending bill. However, the legislation also affects Medicare payments.

The legislation, as of May 20, would marginally increase Medicare physician payments over the next several years, relative to payments scheduled to take effect under current law. However, because the legislation does not address the 2.8% Medicare payment cut this year, even the increased spending included in the bill will not be enough to make up for existing cuts any time soon.

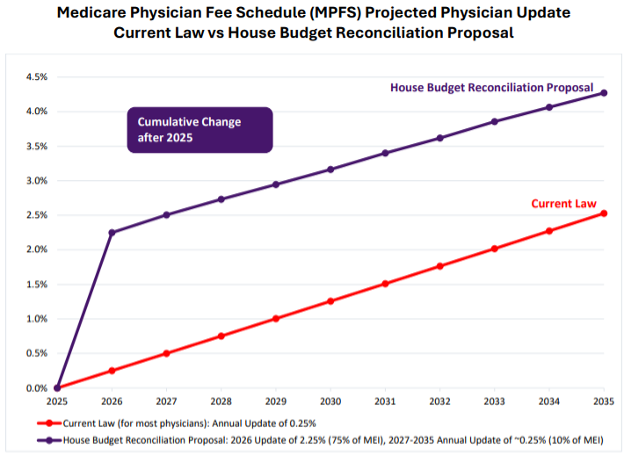

Specifically, the bill takes the existing Medicare rate and increases it by 75% of the Medicare Economic Index (a measure of inflation for practice costs) in 2026 and then by 10% of ME thereafter. This amounts to a payment increase of roughly 2.25% in 2026 and .25% thereafter, falling far short in 2027 and beyond.

However, these payment increases are still higher than those scheduled under current law, which will be capped at .25% for most physicians from 2026 onward in perpetuity. The following AMA graph illustrates this.

However, because the bill does not address the payment cut that took effect this year, the conversion factor in future years under the Medicare Physician Fee Schedule will likely remain lower than the 2024 conversion factor through at least 2028. For instance, while the conversion factor was $33.29 in 2025, it will rise to only $32.95 in 2026, due to the 2.8% cut that previously took effect this year.

So, is this a good deal for physicians? From the standpoint of improving upon current law, the bill’s Medicare provisions are good policy in that they move the needle in the right direction. However, they fall drastically short of an adequate update, let alone comprehensive Medicare payment reform.